- Get link

- Other Apps

- Get link

- Other Apps

The idea of money laundering is essential to be understood for those working within the financial sector. It is a process by which soiled money is transformed into clean money. The sources of the money in precise are criminal and the money is invested in a manner that makes it look like clean money and conceal the identity of the felony part of the money earned.

While executing the financial transactions and establishing relationship with the new prospects or maintaining present customers the duty of adopting adequate measures lie on each one who is a part of the organization. The identification of such ingredient in the beginning is simple to deal with instead realizing and encountering such situations later on within the transaction stage. The central financial institution in any nation provides full guides to AML and CFT to fight such actions. These polices when adopted and exercised by banks religiously provide sufficient safety to the banks to deter such situations.

Have maintained their ACAMS membership. It is one of the best AML Certification.

For The First Time In The Kingdom Of Saudi Arabia A Five

ACAMS Certified Anti-Money Laundering Specialist CAMS Exam Preparation Course 176200 225000.

Certified anti-money laundering specialist cost. This represents a CAMS premium of nearly 42 percent. Not to mention this is the gold mark in AML certifications and accepted globally by financial institutions governments and regulators as a serious engagement to securing the financial system against money laundering. However this pay can exceed depending upon the.

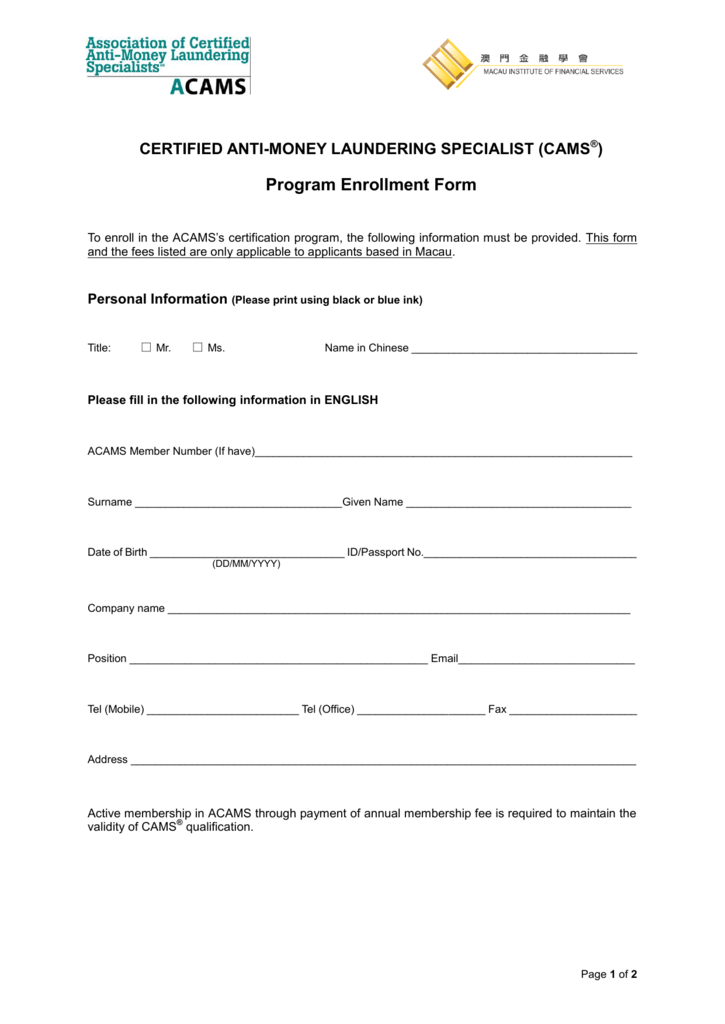

The CAMS exam is offered by the Association of Certified Anti-Money Laundering Specialists ACAMS. The recertification process validates that every Certified Anti-Money Laundering Specialist is maintaining their commitment to continuing professional education. Cost of the course is USD 1495 for private sector applicants.

Also question is how much does the Acams certification cost. This professional association serves to provide exclusive training and certification for anti-money laundering. We offer self-study and enhanced learning packages to get you qualified in as little as three months.

Respondents with the CAMS certification is 85000 compared to 60000 for a non-CAMS certified counterpart. The cost to attend Association of Certified Anti-Money Laundering Specialists ranges from 1300 to 3000 depending on the qualification with a median cost of 1600. CAMS Virtual Classroom includes access to six 2-hour consecutive web-based courses.

About ACAMS Certifications and exam. When asked how they paid for their training most reviewers responded My company paid for my training. Passing grade on the CAMS Exam.

Association of Certified Anti-Money Laundering Specialists ACAMS Qualification and Educational Requirements. Well explore how financial professionals use this certification and why it can be an excellent professional asset. 2500Certified Anti-Money Laundering Specialist CAMS.

The above fee is subject to 19 VAT. Is for accountants CFA is for finance folks. Association of Certified Anti-Money Laundering Specialists ranges from 1200 to 2000 depending on the qualification with a median cost of 2000.

CAMS Certified Anti-Money Laundering Specialist is the global gold standard in AML certifications with more than 40000 CAMS graduates worldwide. What is the best AML certification. So 3 years of working experience can help you complete the 30-credit milestone.

Supply evidence of continuing professional education. The Association of Certified Anti-Money Laundering Specialists ACAMS offers 10 credits for each year of professional experience as an Anti-Money Laundering Specialist. A minimum of 40 qualifying credits based on education other professional certification and professional experience per ACAMS Credit Award System.

The syllabus is comprehensive and best part is the cost Around Rs18000 to Rs. Association of Certified Anti-money Laundering Specialist is the Global Gold Standard Anti-money laundering which is recognized worldwide by employers in both private and government Industries. Certainly the Certified Anti-Money Laundering Specialist CAMS credential is the one-of-a-kind stipulation for financial auditors to fight money laundering.

CAMS Certification Costs and Fees. Becoming certified as an anti-money laundering specialist shows that someone has a commitment to bettering themselves and developing knowledge and skills in the field of financial crime. CAMS stand for Certified Anti-money Laundering Specialist.

This certificate is provided by ACAMS Association of Certified Anti-Money laundering Specialist all over the world. CAMS Certified Anti-Money laundering Specialist is the most prestigious and coveted certification for AML professionals not only in India but the world. The Certified Anti-Money Laundering Specialist CAMS credential is the one-of-a-kind designation for financial auditors to combat money laundering.

When asked how they paid for their training most reviewers responded My company paid for my training. Certified Anti Money Laundering ExpertCAME is the best compliance certification. To recertify professionals must.

This certification has significant value in market for both domestic and International AMLKYC processes. The cost to attend ACAMS. Southpac who also made an investment in my attaining this certification has shown that they take matters of compliance seriously and want to safeguard the.

Detecting bad actors and maintaining industry standards is increasingly difficult which is why Certified Anti-Money Laundering Specialists CAMS are valuable. Complete an online application and pay a recertification fee. CAME is termed as the crown jewel of compliance certifications.

Below are the various CAMS certification costs and fees associated with taking the CAMS examination they include the ACAMS study guide. Certified Anti Money Laundering Specialist CAMs certification salary can have an average base pay is Rs 717k per year.

Cams Certification Review Acams Cost Exam Questions Requirements Reviews Advisoryhq

Cams Certification Review Acams Cost Exam Questions Requirements Reviews Advisoryhq

How Much Does The Acams Certification Cost Blog

Certified Anti Money Laundering

Certified Anti Money Laundering Specialist Cams Arab Institute For Accountants And Legal Aial

Cams Certification Review Acams Cost Exam Questions Requirements Reviews Advisoryhq

Review Advanced Cams Risk Management Cams Rm Certified Advanced Aml Risk Management Specialist Dr Ian Messenger

Join Erm Africa And Be Specialist In Anti Money Laundering And Financial Crime Course Online Exams University Of Ghana Risk Management

Amazon Com Acams Association Of Certified Anti Money Laundering Specialists Exam Practice Questions And Dumps Acams Exam Prep Updated 2020 9798665899732 Books Aiva Books

How Much Does The Acams Certification Cost Blog

Advancing Anti Money Laundering

Certified Anti Money Laundering Professional Swiss School Of Business And Management Geneva

How Much Does The Acams Certification Cost Blog

Certified Anti Money Laundering Specialist Cams Faq Testprep Training Tutorials

The world of regulations can appear to be a bowl of alphabet soup at instances. US money laundering rules are not any exception. Now we have compiled an inventory of the top ten money laundering acronyms and their definitions. TMP Danger is consulting firm focused on defending financial services by lowering threat, fraud and losses. We've big financial institution expertise in operational and regulatory danger. Now we have a strong background in program administration, regulatory and operational threat as well as Lean Six Sigma and Enterprise Course of Outsourcing.

Thus cash laundering brings many hostile penalties to the group because of the dangers it presents. It increases the probability of main risks and the opportunity price of the financial institution and finally causes the bank to face losses.

Comments

Post a Comment